The basics

Introduction: Vermont has a housing crisis, and if you live here (especially if you are a renter or have gone through the home-buying process recently), you probably don’t need to be told that. Although housing solutions might seem simple (why don’t we just build more housing?), how we talk about housing, what we mean when we talk about housing, and what our housing needs are can actually be quite complex. This guide is intended to provide a basic framework so that we can have a common vocabulary when we talk about housing.

In this latest Thriving Communities blog series, we break down the network, language, and housing advocacy into several parts:

- How we measure the housing shortage, and how we talk about it

- What resources illustrate the housing needs and housing gaps

- The different types of housing, shelters, and housing subsidies

- Who the housing providers, financers, and advocates are, and where they serve

- How to be a housing advocate

Chapter 1: The Crunch

–What do we mean when we say “Vermont has a housing crisis?”

Chapter 2: Emergency housing

-Resources for people who are experiencing homelessness (including unsafely housed ) or at risk of becoming homeless

Chapter 3: What is affordable housing?

-What options are there for people who need help paying for their housing, but are not currently homeless?

Chapter 4- Avenues for Advocacy

– What can you do about the affordable housing shortage?

Before going much further, we want to plug again this post on housing committees, a really great place to start if you are looking to make an impact on your local housing landscape. This may hold you over until our final chapter is released! And for those arriving at this resource to understand Vermont affordable housing, subsidized housing, and emergency housing resources, Vermont’s US Department of Housing and Urban Development (HUD) state office has issued this comprehensive guide on Vermont housing and rental assistance.

Finally, a word on why it is important for us to all be educated on housing terminology and avenues for citizen housing advocacy:

Housing as a human right, absolutely foundational to each person meeting their basic needs. Equal opportunity for housing choice is also critical to thriving, inclusive communities because where you live determines your proximity to resources – transportation, social services, jobs – where your kid goes to school, what kinds of foods you can access, and perhaps what environmental conditions you live in. Housing stability is critical to children’s educational growth, to citizen’s ability to be civically engaged, and to overall neighborhood resilience. Homeownership *can* be a path to housing stability and wealth accumulation. The reality is, neither housing choice nor housing stability is guaranteed in our state for a growing number of people, many of whom represent groups of people historically denied equal access to housing.

Want to Learn More about Fair Housing?

- Check out this compelling presentation and discussion about racial discrimination here in Vermont, and the homeownership inequities between white and BIPOC Vermonters.

- Here you can find our overview of Fair Housing milestones throughout US history, and here the timeline continues into our contemporary present.

- The National Fair Housing Alliance has this more comprehensive overview of Fair Housing History as well.

- We are CVOEO’s Fair Housing Project are always happy to offer our Fair Housing workshops to housing and service providers, municipal officials, and the general public. Contact us to schedule or learn more.

What do we mean when we say Vermont is having a housing crisis?

Simply put, we do not have enough housing to fit the needs of our community. A tight housing market also means higher rates of discrimination, as a larger pool of housing-seekers means housing providers can be more selective without consequence, and more susceptible to bias. We measure our housing needs through three major reports:

- The National Low Income Housing Coalition’s Annual Out of Reach Report

- The Vermont Housing Needs Assessment

- The Point in Time Count

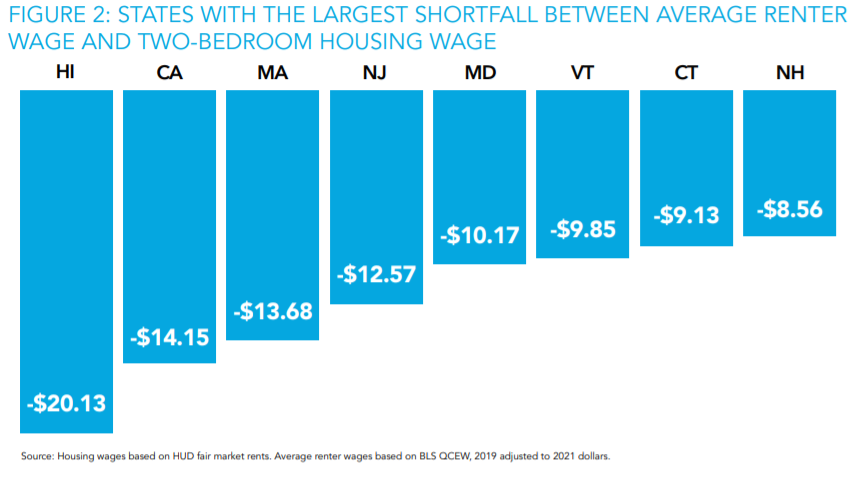

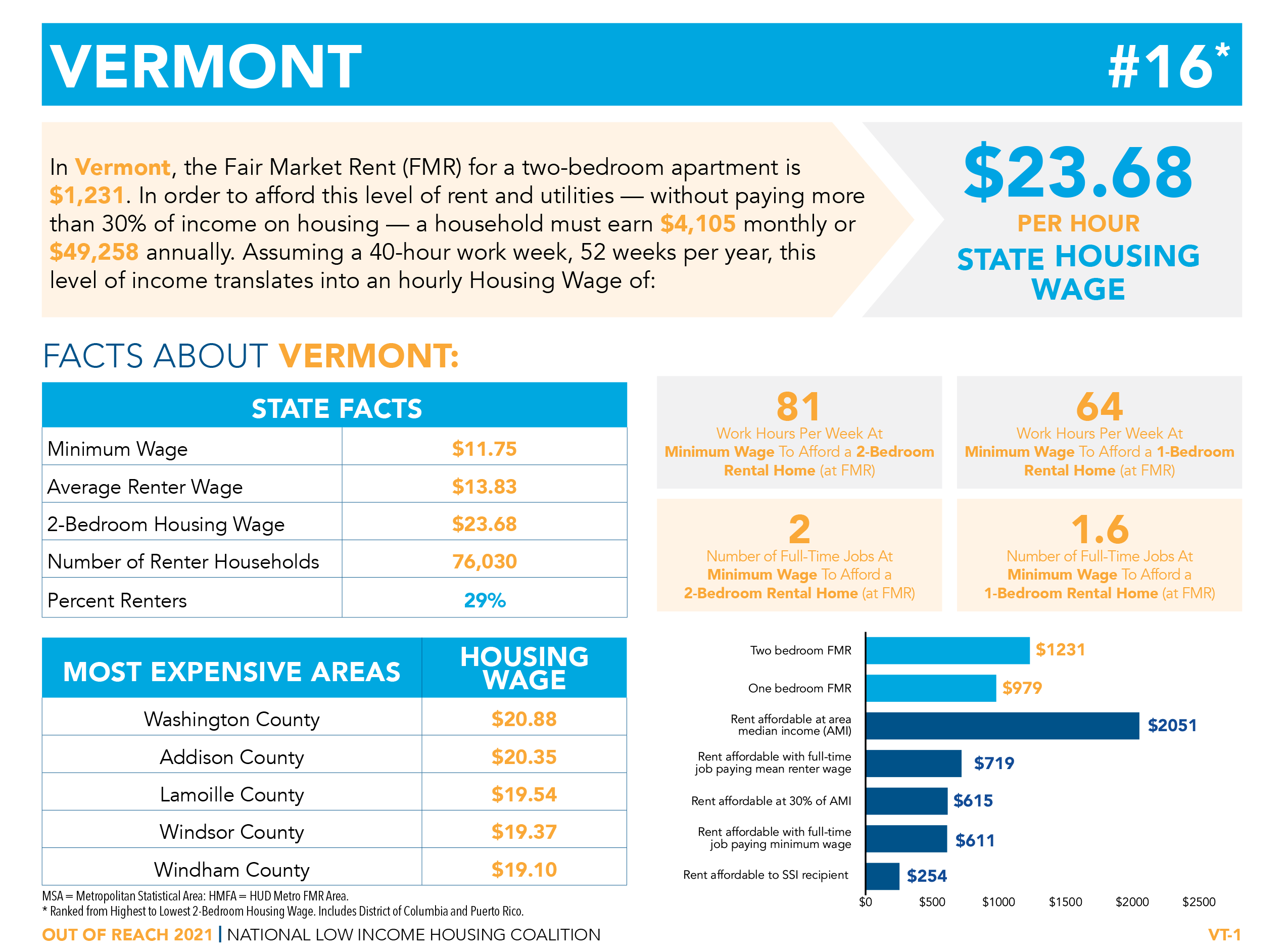

The National Low Income Housing Coalition’s Out of Reach Report: The National Low Income Housing Coalition releases a comprehensive annual Out of Reach Report which documents the gap between renters’ wages and the cost of rental housing across the US. The report’s central statistic, the Housing Wage, is an estimate of the hourly wage a full-time worker must earn to afford a modest rental home at HUD’s fair market rent (FMR) without spending more than 30% of his or her income on housing costs, the accepted standard of affordability. You can check out Vermont’s stats here, and you can even go deeper and by putting in your own town or county. While the Out of Reach report does not measure demographic differences of renters, other statistics confirm that BIPOC renters are disproportionately impacted by these gaps, and both the Vermont Human Rights Commission and Vermont Legal Aid report higher rates of discrimination for people with disabilities.*

The Vermont Housing Needs Assessment: In 2019 the Department of Housing and Community Development hired VHFA to conduct the 5-year Vermont Housing Needs Assessment. This Assessment is used to inform the State’s 5-Year Consolidated Plan to the U.S. Department of Housing and Urban Development (HUD) and other statewide and county housing and policy decisions. You can find the report highlights here. And the full document and fact sheets here. In addition to the written report, VHFA hosts and regularly updates the indicators included in this report on the Community Profile section of www.housingdata.org as a resource for anyone interested in the demographic makeup, housing needs, and economic indicators for communities and regions around Vermont.

The Point in Time Count: This report chronicles the landscape of and changes in homelessness in Vermont in 2022 and over a ten-year period with breakdowns by location of homelessness, household type, and subpopulation. The Annual Point in Time Count is a statewide count of persons experiencing literal homelessness on January 26, 2022. The Count captures the most vulnerable population, those literally homeless and does not include those at risk of homelessness, doubled up, living in unsafe housing, or couch surfing.

In our next chapter of Housing Demystified, we will be digging into the different categories of housing, the organizations which provide them, the different ways affordable housing is financed, and what resources exist for those currently homeless or at risk of homelessness.

What does the crunch mean for you?

For renters:

If you are a renter, knowing your rights under state Landlord-Tenant Law and state & federal Fair Housing Law becomes critical in a tight housing market. It is important for you to know your responsibilities to maintain housing. Fortunately, CVOEO’s Housing Advocacy Program has a wealth of free resources to that end, including the Definitive Guide to Renting, live and self-paced workshops, and a variety of other resources at your disposal. You can find a summary of our programs below and learn more at www.cvoeo.org.

- VERMONT TENANTS: Information, resources, referrals, navigation services, and workshops to help people find and maintain stable housing. Workshops are available in-person and online (live and self-paced) and the Rent Right program combines tenant skills and financial workshops and coaching to result in a preferred renter certificate.

- MOBILE HOME PROGRAM: Information, resources, and support services designed to help mobile home park residents achieve greater control over their housing and protect and improve their housing rights and living conditions. Services include resident organizing, housing counseling, and referrals.

- FAIR HOUSING PROJECT: Consultations, referrals, education, and advocacy for the general public, housing and service providers, and municipal officials with the goal of eradicating illegal housing discrimination and increasing housing opportunity and choice. The Fair Housing Project also coordinates community events, supports local housing committees, facilitates the Thriving Communities initiative, and offers assessments and training related to Affirmatively Furthering Fair Housing and developing inclusive, affordable housing.

- Always, you can call us on our statewide Tenant Hotline if you have any questions about your tenancy Hotline: (802) 864-0099

For low-income renters

While Vermont has a robust affordable housing infrastructure, many housing non-profits have waiting lists. It is important to know what kind of housing you are looking for before beginning your applications. Stay tuned for Housing Demystified Chapter 2: Types of Housing Nonprofits and Programs, and Who They Serve

The Definitive Guide to Renting in Vermont

The Definitive Guide to Renting in Vermont