Millennials become the most numerous living generation this year, outnumbering the Baby Boomers, and there’s no shortage of treatises analyzing their tastes, their world views, and their impact on the housing market. How seriously to take these generalizations, or any other thumbnail pronouncements about generations, is an open question. (For a Pew Foundation exegesis of “generations research” that finds Millennials less religious, more diverse and less conservative than their predecessors — that is, compared to Generation X, Baby Boomers and the Silents(!), click here.)

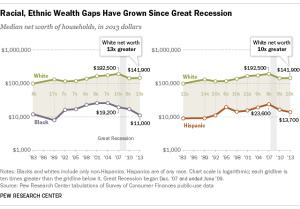

Clearly, though, people born after 1980 tend to have higher levels of student loan debt than their forebears, and fewer are buying houses as a result. Young renters’ student debt burdens grew after the Great Recession, even as their median incomes dropped, which left them less able to qualify for a mortgage or to save for a downpayment. A new research brief from the Harvard Joint Center for Housing Studies, “Student Loan Debt and the Housing Decisions of Young Households,” lays out the details.

Young renters’ student debt burdens grew after the Great Recession, even as their median incomes dropped, which left them less able to qualify for a mortgage or to save for a downpayment. A new research brief from the Harvard Joint Center for Housing Studies, “Student Loan Debt and the Housing Decisions of Young Households,” lays out the details.

Nevertheless, there are commentators who see Millennials as poised to fuel a housing boom. “Millennials are making their move in the housing market,” proclaims the Dallas Morning News, quoting real-estate industry source attributing 30 percent of home sales to Millennials.

The common notion that Millennials want to live in cities is subject to dispute. More Millennials are moving from cities to suburbs than the other way around, Census data supposedly show. A survey came out earlier this year that got plenty of attention: It had 66 percent of Millennials preferring a life in suburbs, 24 percent rural areas, and just 10 percent cities.

The survey was sponsored by the National Association of Home Builders, though — an entity that would seem to have a vested interest in promoting the single-family-home-big-yard lifestyle.

But wait. A survey closer to home suggests that many Millennials really do hanker for a single-family home with a big yard. The 2014 “Young Professional Housing Survey Report,” sponsored by the Lake Champlain Regional Chamber of Commerce, asked 400 respondents (63 percent of whom were renters) what type of residence they would most like to live in, and 82 percent said single-family detached house with a yard. And most of those wanted a big yard!

Now, to the extent that these Burlington-area Millennials prefer suburban living, they do want to live in a place that’s a short commute to work, and a place where they can walk to community services.

Still, the young cohort seems to cling to the old American dream of a low-density-neighborhood lifestyle. Hasn’t anyone told them that big yards are obsolete in the Age of Climate Change?