ProPublica has a fine expose on racial disparities in debt-collection litigation. Reporters examined court judgments in St. Louis, Chicago and Newark and found that court judgments were twice the size in predominantly black neighborhoods compared to predominantly white neighborhoods – even controlling for income. African Americans significantly more likely than whites to be sued by debt collectors.

So what, you might ask, does this have to with housing, or more particularly, housing discrimination (AKA fair housing)?

Two things:

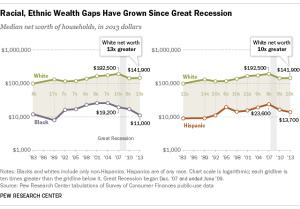

- One inference from the findings is that blacks tend to have less resources – less wealth – to fall back on in hard times. Specifically, they have less wealth in the form of home equity to pass on one from one generation to the next, and that’s a legacy of housing racial discrimination that was promoted and enforced by governments at all levels – and notably, by the federal government from the 1930s on.

As the ProPublic article puts it:

“Experts cite many reasons why blacks might face more lawsuits, foremost among them the immense gap in wealth between blacks and whites in the U.S. It’s a gap that extends back to the institution of slavery and, more recently, to 20th century policies that promoted white homeownership while restricting it for blacks.”

That gap has even widened since the Great Recession, according to the Pew Foundation. The typical black household has a net worth more than 10 times less that of the typical white household:

- The other connection to fair housing is that the racial disparity in debt-litigation cases runs parallel to the racial disparity in predatory lending that was revealed during the housing bubble years of the early 2000s. In many areas, blacks were steered to expensive home loans even when they could have qualified for standard mortgage loans. The debt collectors insist they’re treating everyone the same and not screening cases by race. That may be true, but the mass effect is similar to that produced when minorities were are targeted by predatory lenders in the years leading up to the Great Recession.

For a brief description of how a bank was called to account under the Fair Housing Act, check out this synopsis of a case that the civil rights law form Relman, Dane & Colfax filed against Wells Fargo in Baltimore, or this summary in the Baltimore Sun.