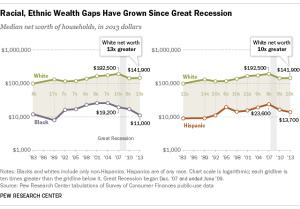

A key goal of affirmatively furthering fair housing (AFFH), as it’s envisioned playing out around the country, is to break up concentrations of poverty and to promote socioeconomic and racial integration. That means ensuring opportunities for lower-income people and racial minorities to live in wealthier, “high opportunity” neighborhoods with access to jobs, goods schools and public services.

Two ways to facilitate those opportunities:

- Promote regional mobility among people with Section 8 vouchers, enabling them to leave high-poverty areas and move into more well-to-do communities. This can require increasing their housing allowance so that they can afford higher suburban rents.

- Build affordable, multifamily rental housing in those same, heretofor exclusive neighborhoods.

Both of these approaches deserve consideration around here, as Vermonters contemplate how to make their communities more socioeconomically inclusive. Meanwhile, it’s interesting to see how they’ve played out in an entirely different environment: metropolitan Baltimore.

First, some background: Baltimore has a long history of racial segregation (click here for a trenchant account), and in the mid-1990s, the Department of Housing and Urban Development was sued by city residents (Thompson vs. HUD) for its failure to eliminate segregation in public housing. In 2005, a federal judge found that HUD had violated the Fair Housing Act by maintaining existing patterns of impoverishment and segregation in the city and by failing to achieve “significant desegregation” in the Baltimore region.

Seven years later, a court-approved settlement resolved the case in a way that anticipated the AFFH rule that HUD issued this past summer.

The settlement called on HUD to continue the Baltimore Mobility Program, begun in 2003 in an earlier settlement phase. The program has provided housing vouchers to more than 2,600 families to move out of poor, segregated neighborhoods and into areas with populations that are less than 10 percent impoverished and less than 30 percent black. The program provides counseling before and after the move and has received high marks from evaluators who cite improved educational and employment outcomes for beneficiaries. A similar regional program is underway in Chicago.

The settlement also called for affordable-housing development in these “high-opportunity” suburban communities – 300 units a year through 2020. To make this happen, HUD was to provide new financial incentives for developers.

Here is where the story takes a dispiriting turn. Three years later, not a single developer has applied for the incentives. No affordable housing projects are even in the pipeline. That’s according to an eye-opening story the other day in the Baltimore Sun.

So, what happened? Why haven’t developers shown any interest? HUD had no explanation, according to the story, which suggested that perhaps the program hadn’t been well-enough publicized: a prominent builder of affordable housing admitted he didn’t even know about the incentives. Could it be that they weren’t generous enough?

Whatever the reason, the Baltimore experience reflects how difficult it can be to introduce affordable housing to privileged enclaves. No one should underestimate the AFFH challenge.