This country’s shortage of affordable rental units runs into the millions, and Vermont’s is in the thousands. Where’s the money going to come from to build or rehab our way out of this hole? Government spending falls chronically and abysmally short, but there’s a glimmer of hope that a growing fraction of the massive need can come from an unlikely source: private investors.

But first, consider the scale of the need. According to the recent Harvard report on rental housing, 11.4 million renter households are “severely burdened,” paying more than 50 percent of their income for housing. (An additional 9.9 million are simply “burdened,” paying more than 30 percent.)

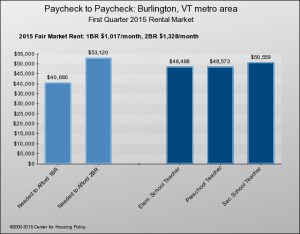

In Vermont, 26 percent of the 75,000 renter households are severely burdened — that’s 19,500 households living in places that are far beyond their means. And in Burlington, 35 percent of the 9,500 renter households are in that position – about 3,300 households.

The federal government’s primary subsidy for affordable housing development is the Low Income Housing Tax Credit, which produces in about 100,000 affordable rental units a year. Then of course there’s the challenge of maintaining affordability for units whose tax credits expire, a challenge that Vermont’s housing nonprofits and state agencies contend with annually as they marshal limited public resources to preserve the affordability of what’s here. And even though they’ve been largely successful, what’s here isn’t anywhere near enough. Yes, the private market is turning out new rental housing to meet the growing population of renters, but the great majority of those new units are high-end.

A new report from the Urban Land Institute and NeighborWorks America, “Preserving Multifamily Workforce and Affordable Housing,” describes a range of new financing vehicles that seek to create or preserve affordable housing. Sixteen partnerships o investment companies – some new, some well-established — are profiled. One thing they have in common is that they offer returns to their investors– who include philanthropies, university endowments, pension funds and private individuals in the single digits, below what the typical real-estate investor might expect to receive. These entities include private equity funds and two real estate investment trusts (REITs) that focus on affordable multifamily developments.

The hook is that this investment sustains a social good: affordable housing. If “socially responsible investing” is popular among Vermont’s progressive monied class, why can’t affordable housing be one of their fiduciary causes? A creative financier might even find some way to enlist the UVM endowment or the state pension fund in support of affordable housing development.

The report also mentions another possible funding source for affordable housing — the EB-5 program, which pulls in big investments from foreigners (typically from East Asia) in exchange for green cards, and which we’ve harped on before. Yes, EB-5 is supposed to be a job-creation program, but it turns out that real estate development developments are among the most popular EB-5 projects, in part because the construction jobs count. (Check out this article, “Real Estate: Still the Darling of EB-5.”) True, affordable housing isn’t the typical EB-5 project, but it has been done – in San Francisco’s Hunter’s Point Shipyard, and in Seattle, near the Seahawks’ stadium. Next up, Miami.

How about Newport, Vt.?