Continue reading Affordable Housing Still Out of Reach for Low-Wage Workers

Category Archives: Vermont

CVOEO Welcomes Jessica Hyman to the Fair Housing Project

WORKING TOWARD ACCESS FOR ALL – Fifty Years of the Fair Housing Act: a Vermont Perspective

FHP organized event in front of Burlington, VT City Hall Continue reading WORKING TOWARD ACCESS FOR ALL – Fifty Years of the Fair Housing Act: a Vermont Perspective

Affordable housing advocates foresee $15 million drop in investment due to tax reform | True North Reports

By Briana Bocelli, a freelance writer for True North Reports. 12/6/17

“The House and Senate tax bills could be detrimental to an already struggling affordable housing situation in Vermont, according to estimates released by the Vermont Affordable Housing Coalition.”

Easing Burlington’s Housing Shortage, Opinion by Erhard Mahnke

(This piece first appeared on the Burlington Free Press opinion page on September 20, 2017)

Safe, stable and affordable housing is essential for a community to thrive economically, socially and culturally. Vermont continues to struggle with housing affordability, and unfortunately the state’s largest city of Burlington is no exception.

A Burlington resident needs to earn over $26 an hour to afford the fair market rent for a two bedroom apartment – that’s more than $5 per hour above the national average.

This is troubling and we hear about the ramifications from families and seniors who can’t find places to live, from young people who are choosing to leave the state for more affordable areas, from agencies serving the homeless, and from our employers who struggle to find qualified employees due to the high cost of housing.

There are several components to addressing the issue of affordable housing, and one of the most critical is the need for capital investment to build new housing and to renovate existing properties. While many additional homes have been built over the past several years, many more are needed to accommodate the growth of 2,375 new households projected for Chittenden County by 2020. Current production is being absorbed into the market quickly, and the long-term vacancy rate for rentals still hovers between 1 and 2 percent, putting supply and demand out of whack.

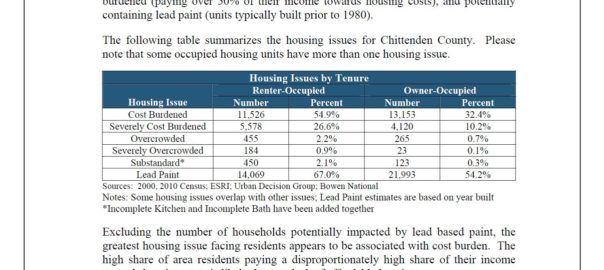

Not surprisingly, according to Census data, over half of Chittenden County renters are “cost-burdened,” meaning they pay too much of their income for housing, leaving them without enough for other basic necessities.

In terms of affordable housing, last month the Champlain Housing Trust had just five vacancies among their 2,000 plus apartments, and only one vacancy in Chittenden County. Cathedral Square Corp. had over 800 seniors and people with special needs on its waiting list looking to move into affordable housing.

Furthermore, the effective vacancy rate for subsidized rentals in Chittenden County was literally 0 percent for all bedroom sizes. These shocking numbers help explain why the Burlington Housing Authority typically measures their waiting list in years rather than weeks or even months.

These numbers are astonishing, but the good news is that there are clear steps we can take to address the cost of housing. No one project will be the panacea for Burlington’s affordable housing crisis, but developments like the proposed Cambrian Rise project in Burlington’s North End can significantly improve housing options for residents and relieve the pressure on a strained system.

As proposed, Cambrian Rise will be a 739-apartment mixed-income housing neighborhood with an impressive number of affordable homes. The neighborhood will offer Burlington residents housing options for all income levels.

Under Burlington’s inclusionary zoning ordinance, the development will include 128 affordable rentals for families and seniors with household incomes of less than 65 percent of the Chittenden County median income. In English that translates into housing that is affordable for a one-person household making $37,500, or $53,600 for a family of four.

However, with federal, state and local dollars available to Champlain Housing Trust and Cathedral Square, which are partnering to help create Cambrian Rise, many apartments will be even more affordable.

Furthermore, another 60 homes will be affordable to homebuyers earning below 75 to 80 percent of median income, or below at most $46,150 for a single individual and $65,900 for a family of four. In all, the development will offer 188 permanently affordable homes to low income Vermonters. In addition, Cambrian Rise will offer “workforce housing” for sale and rent targeted to more moderate income people up to 120 percent of the median income. Our working families, our seniors and people with disabilities, and our employers desperately need these new homes.

Cambrian Rise not only offers a diverse neighborhood, it is also a model for sustainable development. The project features alternative transportation options, energy efficiency, a state of the art stormwater system to protect the lake, and a conserved 12-acre public park – giving us continuous public access to Lake Champlain from Perkins Pier to North Beach.

Convenient access to the bike path, car share opportunities and a heated bus terminal for year-round use will ease the financial burden for residents of the neighborhood. This mixed-use development is a model for the future, where diverse residents of all income levels, abilities and ages can live, work and play in one neighborhood.

Erhard Mahnke, of Burlington, is coordinator for the Vermont Affordable Housing Coalition. The Vermont Affordable Housing Coalition is a partner organization in the Thriving Communities- Building a Vibrant Inclusive Vermont campaign.

Affordable Housing Is Out of Reach for Low -Wage Vermonters

June 8, 2017

Read the full Vermont Affordable Housing Coalition press release.

Why Chittenden County Still Needs More Housing

My Turn, From the Burlington Free Press

” … we applaud efforts in Montpelier and are excited to work with local municipalities that want to make bold investments in affordable housing, realizing that such investments are winners in accomplishing Governor Scott’s three priorities: supporting our economy, making Vermont more affordable for Vermonters, and protecting our most vulnerable community members. Several proposals have been made – we welcome all efforts that satisfy each of these three objectives.”

by Michael Monte

There seems to be a burst of housing construction in Chittenden County, and some are even suggesting that the tide has turned in making the rental market more affordable, or that the vacancy rate is high enough, or we’re building too fast. At the Champlain Housing Trust, our assessment is that although the trend line is improving, more needs to be done – especially for low wage earners priced out of the market, and certainly for the 350 people on any given night in the county who have no home at all.

According to Mark Brooks, co-author of a report that provides a comprehensive semi-annual analysis of the real estate market, the long-term market vacancy rate in Chittenden County is 2%. The December, 2016 report indicated a market vacancy of 4.4% – a number offered as a point-in-time rate of what’s available without taking in consideration the timing of apartments just completing construction or other factors.

According to Mark Brooks, co-author of a report that provides a comprehensive semi-annual analysis of the real estate market, the long-term market vacancy rate in Chittenden County is 2%. The December, 2016 report indicated a market vacancy of 4.4% – a number offered as a point-in-time rate of what’s available without taking in consideration the timing of apartments just completing construction or other factors.

This lower rate is a more accurate assessment, as it takes into account the time in which newly-constructed apartments are absorbed into the market. Most will agree that a 5% rate will yield a healthy market for renters and owners alike. While we were close at a point in time in December, we’ve not sustainably reached this target.

In the last two years alone, over 1,200 apartments have been constructed. The new construction does give some renters more choices: according to the report, “…landlords are offering incentives such as one month free rent, flexible lease terms, or lower rents.” Rent rates across the board have been stable and closer in-line with inflation – unlike the previous six years.

New households are forming every day in Chittenden County, and large numbers of people are still commuting long distances from less expensive housing in more rural counties to get to work. In fact, in 2002, 73% of Chittenden County workers lived in the county; that percentage dropped to 63% in 2014. Lack of housing opportunity is leading more and more workers to commute longer distances.

Demand is still high as younger people, sometimes saddled with high college debt, are renting instead of purchasing a new home. And employers are still viewing rents and housing availability as being barriers to economic growth. A representative of one business told us recently that her company added jobs in the mid-west instead of Burlington because of the lack of housing.

In order to push the underlying market rate from 2% to a sustained 5%, we need to continue to provide additional growth. Can we sustain this growth and increase the vacancy rate in the future? We hope so. But next year fewer apartments are on track to be coming on line, less than half the number built this year. And although there are an additional 2,400 apartments in the development pipeline county-wide, those won’t be here next year, or even the year after that.

As importantly, the resources available for affordable housing are seriously limited. Although there is enormous opportunity and capacity to build more affordable housing, the equity or cash needed to insure that rents remain affordable are not available. Non-profit owners continue to struggle with meeting the demand for more affordable housing, as evidenced by long waiting lists for subsidized housing or the 150 applications CHT gets every month for the 20-25 apartments available.

That’s why we applaud efforts in Montpelier and are excited to work with local municipalities that want to make bold investments in affordable housing, realizing that such investments are winners in accomplishing Governor Scott’s three priorities: supporting our economy, making Vermont more affordable for Vermonters, and protecting our most vulnerable community members. Several proposals have been made – we welcome all efforts that satisfy each of these three objectives.

————————————————————————————————————————-

Michael Monte, is Chief Operations & Financial Officer at The Champlain Housing Trust, founded in 1984, it is the largest community land trust in the country. Throughout Chittenden, Franklin and Grand Isle counties, CHT manages 2,200 apartments, stewards 565 owner-occupied homes in its signature shared-equity program, offers homebuyer education and financial fitness counseling, provides services to five housing cooperatives, and offers affordable energy efficiency and rehab loans. In 2008, CHT won the prestigious United Nations World Habitat Award, recognizing its innovative, sustainable programs.

Coalition Launched to Increase Housing in Chittenden County VT

South Burlington, VT – Dozens of Chittenden County leaders in the fields of housing, business, local and state government, and social services announced this morning a new campaign to increase the production of housing and setting a target of 3,500 new homes created in the next five years.

The new coalition, called Building Homes Together, was formed by the Champlain Housing Trust, Chittenden County Regional Planning Commission and Housing Vermont and released an initial list of nearly 100 community leaders supporting the effort.

“Working together we will accomplish this goal,” said Brenda Torpy, CEO of Champlain Housing Trust. “For the sake of our communities, our workers and local economy, we will educate and advocate together for more housing.”

“The housing shortage in Chittenden County has been well noted with unhealthy vacancy rates and high rents,” added Charlie Baker, Executive Director of the Chittenden County Regional Planning Commission. “Employers can’t find workers, and workers themselves spend more time in commutes and with a higher percentage of their paychecks on housing costs.”

Twenty percent of the 3,500 goal are targeted to be developed by nonprofit housing organizations. The remainder by private developers.

“This step-up in production will not just provide new homes and infrastructure for communities, it’ll be a boost to the economy and contribute to the tax base. Building homes together is a big win for all of us in Chittenden County,” said Nancy Owens, President of Housing Vermont.

The campaign will provide up-to-date data to the community on the need for and benefits of new housing, build cross-sector and public support for housing development, increasing access to capital, and supporting municipalities.

Individuals, businesses or organizations that wish to sign on and participate in the campaign are encouraged to by sending an email to Chris Donnelly at Champlain Housing Trust (chris@champlainhousingtrust.org). For more information, visit www.getahome.org/news/building-homes-together

Bullish on mobile homes

It seems that the wide-ranging portfolio of Warren Buffett, investment sage and one of the world’s richest men, includes a mobile-home empire that’s coming under fair-housing scrutiny.

That’s Clayton Homes Inc., the leading maker of mobile homes, which Buffett’s Berkshire Hathaway bought in 2003. A Clayton affiliate is also the leading lender to purchasers of mobile homes.

Now comes an investigative series by the Seattle Times, the Center for Public Integrity and BuzzFeed alleging exploitative lending to minorities, not to mention racist employment practices. One of the key predatory-lending allegations is summed up by this sentence, the series’ third article published the other day:

“The company’s in-house lender, Vanderbilt Mortgage, charges minority borrowers substantially higher rates, on average than their white counter parts. In fact, federal data shows that Vanderbilt typically charges black people who make over $75,000 a year slightly more than white people who make only $35,000.”

To this and the series’ accusations launched beginning in April, Clayton issued a “categorical” denial in a press release dated Dec. 26, stating, among other things:

“(I)n 2015, for borrowers with credit scores less than 600 who chose to purchase a home-only placed on private land, and borrowed less than $50,000, the average note rate from Vanderbilt was the same for white and non-white borrowers. For borrowers with credit scores greater than 720, the note rate for non-white borrowers was 0.07 percent less than for white borrowers.”

Buffett stands by the company and told shareholders this past spring that he “makes no apologies whatsoever for Clayton’s lending terms.”

Most of the alleged depredations highlighted in the articles have taken place in the south and on native American reservations in the Southwest. Clayton does have a presence in Vermont. The company’s website lists two sales outlets in the state – in Montpelier and White River Junction – out of more than a thousand dealerships nationwide.

If the series’ allegations have legs, one might expect they’ll prompt a federal investigation or a reverse-redlining lawsuit of the sort that was lodged against Wells Fargo for preying on minority home-buyers in Baltimore and Memphis in the years leading up to the housing bust.

Not so easy

A key goal of affirmatively furthering fair housing (AFFH), as it’s envisioned playing out around the country, is to break up concentrations of poverty and to promote socioeconomic and racial integration. That means ensuring opportunities for lower-income people and racial minorities to live in wealthier, “high opportunity” neighborhoods with access to jobs, goods schools and public services.

Two ways to facilitate those opportunities:

- Promote regional mobility among people with Section 8 vouchers, enabling them to leave high-poverty areas and move into more well-to-do communities. This can require increasing their housing allowance so that they can afford higher suburban rents.

- Build affordable, multifamily rental housing in those same, heretofor exclusive neighborhoods.

Both of these approaches deserve consideration around here, as Vermonters contemplate how to make their communities more socioeconomically inclusive. Meanwhile, it’s interesting to see how they’ve played out in an entirely different environment: metropolitan Baltimore.

First, some background: Baltimore has a long history of racial segregation (click here for a trenchant account), and in the mid-1990s, the Department of Housing and Urban Development was sued by city residents (Thompson vs. HUD) for its failure to eliminate segregation in public housing. In 2005, a federal judge found that HUD had violated the Fair Housing Act by maintaining existing patterns of impoverishment and segregation in the city and by failing to achieve “significant desegregation” in the Baltimore region.

Seven years later, a court-approved settlement resolved the case in a way that anticipated the AFFH rule that HUD issued this past summer.

The settlement called on HUD to continue the Baltimore Mobility Program, begun in 2003 in an earlier settlement phase. The program has provided housing vouchers to more than 2,600 families to move out of poor, segregated neighborhoods and into areas with populations that are less than 10 percent impoverished and less than 30 percent black. The program provides counseling before and after the move and has received high marks from evaluators who cite improved educational and employment outcomes for beneficiaries. A similar regional program is underway in Chicago.

The settlement also called for affordable-housing development in these “high-opportunity” suburban communities – 300 units a year through 2020. To make this happen, HUD was to provide new financial incentives for developers.

Here is where the story takes a dispiriting turn. Three years later, not a single developer has applied for the incentives. No affordable housing projects are even in the pipeline. That’s according to an eye-opening story the other day in the Baltimore Sun.

So, what happened? Why haven’t developers shown any interest? HUD had no explanation, according to the story, which suggested that perhaps the program hadn’t been well-enough publicized: a prominent builder of affordable housing admitted he didn’t even know about the incentives. Could it be that they weren’t generous enough?

Whatever the reason, the Baltimore experience reflects how difficult it can be to introduce affordable housing to privileged enclaves. No one should underestimate the AFFH challenge.