(This piece first appeared on the Burlington Free Press opinion page on September 20, 2017)

Safe, stable and affordable housing is essential for a community to thrive economically, socially and culturally. Vermont continues to struggle with housing affordability, and unfortunately the state’s largest city of Burlington is no exception.

A Burlington resident needs to earn over $26 an hour to afford the fair market rent for a two bedroom apartment – that’s more than $5 per hour above the national average.

This is troubling and we hear about the ramifications from families and seniors who can’t find places to live, from young people who are choosing to leave the state for more affordable areas, from agencies serving the homeless, and from our employers who struggle to find qualified employees due to the high cost of housing.

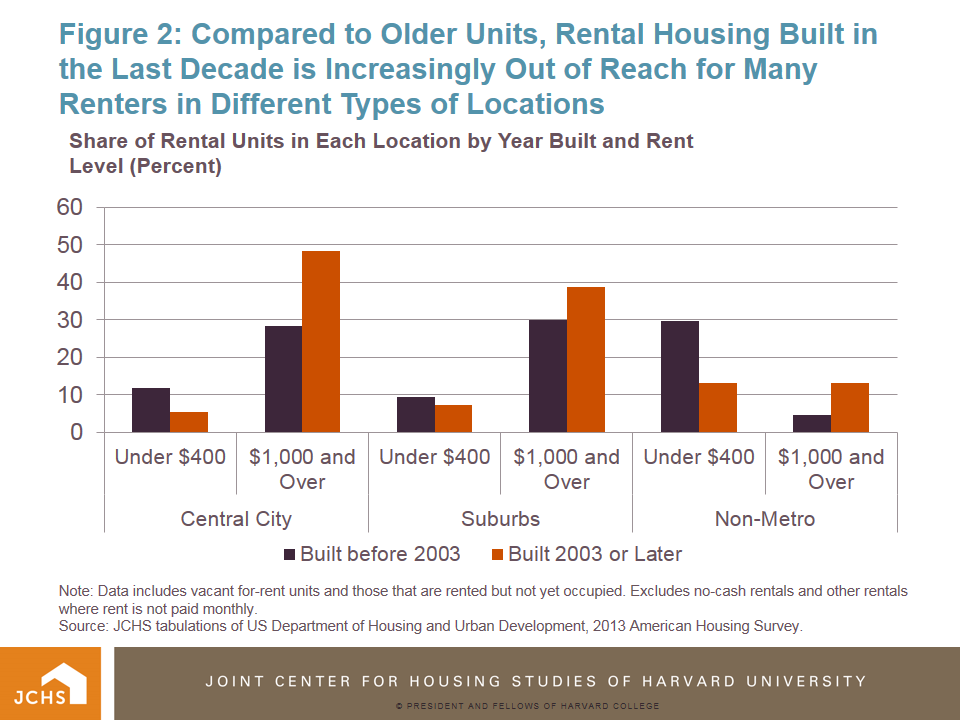

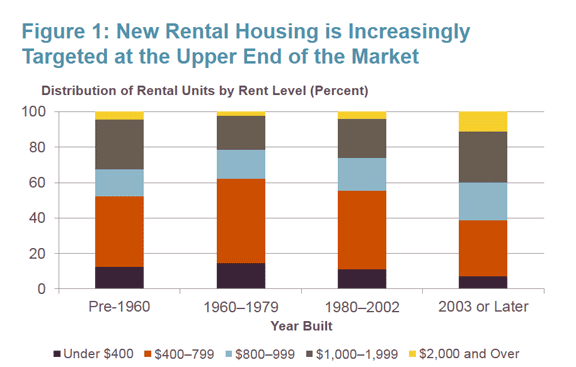

There are several components to addressing the issue of affordable housing, and one of the most critical is the need for capital investment to build new housing and to renovate existing properties. While many additional homes have been built over the past several years, many more are needed to accommodate the growth of 2,375 new households projected for Chittenden County by 2020. Current production is being absorbed into the market quickly, and the long-term vacancy rate for rentals still hovers between 1 and 2 percent, putting supply and demand out of whack.

Not surprisingly, according to Census data, over half of Chittenden County renters are “cost-burdened,” meaning they pay too much of their income for housing, leaving them without enough for other basic necessities.

In terms of affordable housing, last month the Champlain Housing Trust had just five vacancies among their 2,000 plus apartments, and only one vacancy in Chittenden County. Cathedral Square Corp. had over 800 seniors and people with special needs on its waiting list looking to move into affordable housing.

Furthermore, the effective vacancy rate for subsidized rentals in Chittenden County was literally 0 percent for all bedroom sizes. These shocking numbers help explain why the Burlington Housing Authority typically measures their waiting list in years rather than weeks or even months.

These numbers are astonishing, but the good news is that there are clear steps we can take to address the cost of housing. No one project will be the panacea for Burlington’s affordable housing crisis, but developments like the proposed Cambrian Rise project in Burlington’s North End can significantly improve housing options for residents and relieve the pressure on a strained system.

As proposed, Cambrian Rise will be a 739-apartment mixed-income housing neighborhood with an impressive number of affordable homes. The neighborhood will offer Burlington residents housing options for all income levels.

Under Burlington’s inclusionary zoning ordinance, the development will include 128 affordable rentals for families and seniors with household incomes of less than 65 percent of the Chittenden County median income. In English that translates into housing that is affordable for a one-person household making $37,500, or $53,600 for a family of four.

However, with federal, state and local dollars available to Champlain Housing Trust and Cathedral Square, which are partnering to help create Cambrian Rise, many apartments will be even more affordable.

Furthermore, another 60 homes will be affordable to homebuyers earning below 75 to 80 percent of median income, or below at most $46,150 for a single individual and $65,900 for a family of four. In all, the development will offer 188 permanently affordable homes to low income Vermonters. In addition, Cambrian Rise will offer “workforce housing” for sale and rent targeted to more moderate income people up to 120 percent of the median income. Our working families, our seniors and people with disabilities, and our employers desperately need these new homes.

Cambrian Rise not only offers a diverse neighborhood, it is also a model for sustainable development. The project features alternative transportation options, energy efficiency, a state of the art stormwater system to protect the lake, and a conserved 12-acre public park – giving us continuous public access to Lake Champlain from Perkins Pier to North Beach.

Convenient access to the bike path, car share opportunities and a heated bus terminal for year-round use will ease the financial burden for residents of the neighborhood. This mixed-use development is a model for the future, where diverse residents of all income levels, abilities and ages can live, work and play in one neighborhood.

Erhard Mahnke, of Burlington, is coordinator for the Vermont Affordable Housing Coalition. The Vermont Affordable Housing Coalition is a partner organization in the Thriving Communities- Building a Vibrant Inclusive Vermont campaign.