The presidential candidates have a lot to say about tax reform, but with one exception, they’re not about to get rid the big sacred cow — the mortgage-interest deduction, found on Schedule A of Form 1040:![]()

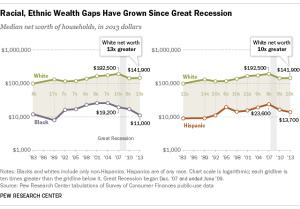

Economists have been complaining about the mortgage-interest deduction for years. It’s a regressive benefit, increasing with income. It enhances inequality, effectively inflates property values and misallocates resources, or so the argument goes. In 2012, the mortgage interest deduction cost the federal government $70 billion, according to the Urban Institute, compared $36 billion for low-income housing subsidies.

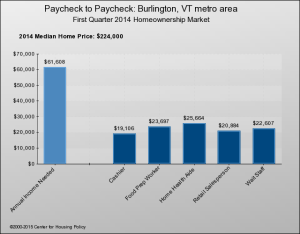

But nobody expects that deduction to go away any time soon. It’s a firmly entrenched loophole (aka “third rail”) not only for the wealthy elite, but for the simple majority. The home ownership rate in this country exceeds 60 percent (in Vermont, it’s over 70 percent), and of course the lion’s share of those people are mortgage-holder beneficiaries.

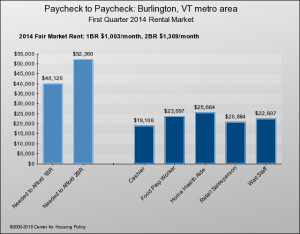

The ranks of renters are increasing, though, and the more they do, the more seriously they might be taken as a political constituency. Politicians take renters seriously in Germany, where renters are in the majority and the regulatory climate is much more in their favor. Germany doesn’t offer a mortgage-interest deduction, either.

Might the growing numbers of American renters be mobilized to support the elimination of the mortgage-interest deduction — which ostensibly doesn’t benefit them anyway — in favor of increased housing subsidies for low- and moderate-income tenants? That seems like a stretch, unless another Occupy-style movement sweeps the country.

Well, if eliminating the mortgage-interest deduction discourages home ownership, so be it. There’s even evidence that home ownership isn’t necessarily such a wonderful thing, because it damages labor markets:

“We find that rises in the home- ownership rate in a U.S. state are a precursor to eventual sharp rises in unemployment in that state,” write economists David Blanchflower and Andrew Oswald, in a 2013 paper. Why? Partly because higher rates of homeownership curtail labor mobility and lead to longer commutes.

So, who’s the exception among the presidential candidates? Ben Carson.  He’s the only one who has said he’d do away with the mortgage-interest deduction. (Even Bernie Sanders doesn’t go that far – he’d cap it at $300,000.) For a full-throated defense of this Carson stance from someone who doesn’t agree with much of anything else he says, click here.

He’s the only one who has said he’d do away with the mortgage-interest deduction. (Even Bernie Sanders doesn’t go that far – he’d cap it at $300,000.) For a full-throated defense of this Carson stance from someone who doesn’t agree with much of anything else he says, click here.