How to vote, Vermont candidates, and resources to help you make a decision

Vermont’s primary elections will be held next week, on August 9th. These elections elect each party’s candidate for both local (e.g., state senator) and national (e.g., US senator) positions for the November midterms. Both local and national representatives can have a big impact on the type of policies that do and don’t get passed. Vermont is in a housing crunch – so it’s important that we work to elect representatives who are going to advocate for fair and affordable housing at both the national and state level.

How to vote

Voter registration: all US citizens who will be 18 or older on Nov. 8, 2022 are eligible to register to vote.

- You can check if you’re registered to vote at this website

- If you’re not registered, you can register:

- At your town clerk’s office prior to the election

- In person at your polling place on election day

- Online or by mail, through the Vermont Secretary of State’s office website

There are two ways to vote

- Early voting, by mail or in person from June 24 through August 8

- VTDigger just reported that the Secretary of State’s office has advised people who haven’t mailed their ballot yet to instead give it directly to their local town or city clerk or to drop it in their town’s dedicated ballot drop box to ensure their ballot is counted

- You can find out if your town or city has a secure ballot drop box at this website

- You can find the location of your town clerk’s office at this website

- In-person voting on August 9

- You can find your local polling place at this website

- Remember: you can register to vote on the day of the election at your local polling place!

- Accessible voting: Disabled Vermonters can use the state’s accessible voting system

- As an online voting interface during the early voting period, June 24-August 8

- As a tablet-based system for in-person use at polling places on August 9

Vermont candidates

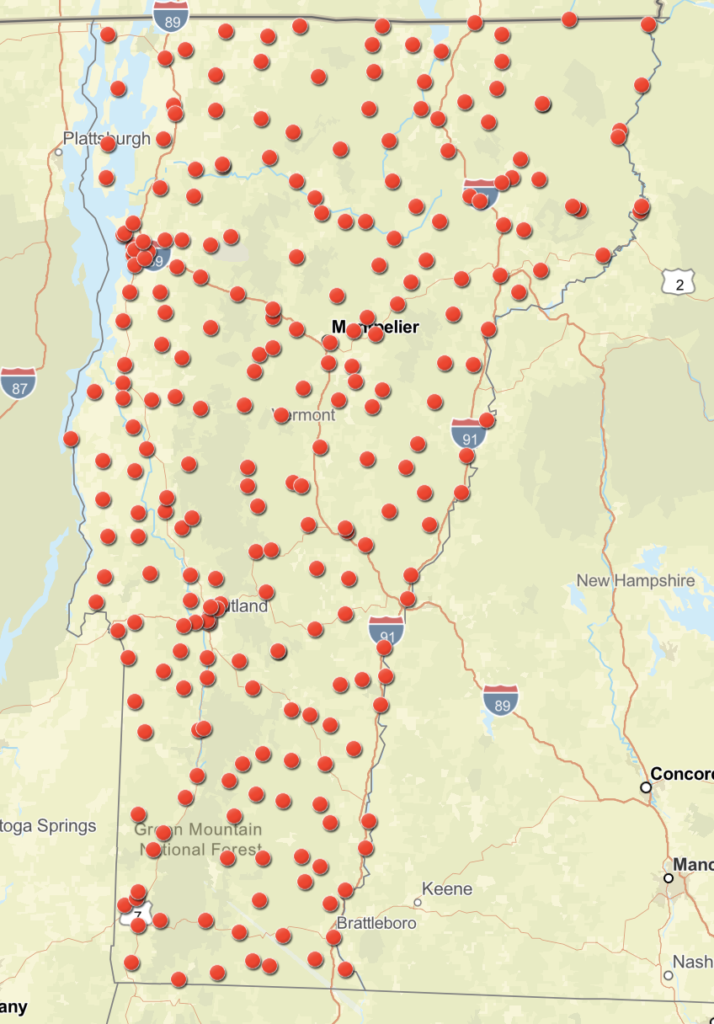

There are both county-wide (state senator; state representative) and statewide (US Senate, US House, Governor, Lieutenant Governor, Secretary of State, Attorney General, State Treasurer, Auditor of Accounts) races.

- Check out the candidates for statewide office at this website

- Check out the candidates for local office at this page – scroll down to “candidate directory”

Key races

- Vermont’s sole US House seat is open for the first time since Peter Welch was elected in 2006 (he took office in January 2007). Current polls have Democratic candidate Becca Balint in the lead

- Incumbent Chittenden Co. state’s attorney, Sarah George, is facing a challenge from fellow Democrat Ted Kenney. George’s progressive approach to the justice system has drawn criticism from some quarters – Kenney describes it as “overly lenient”. Police and firefighters’ unions have backed Kenney in the race. Read more in this article from VTDigger and this article from Seven Days

What to think about when making a decision

Local and statewide elected representatives have a hand in determining state-level and federal policy, which can have major impacts on life here in Vermont.

- Senators Leahy and Sanders have both just announced the approval of millions of funding, requested on behalf of Vermont projects, in the FY2023 Senate Appropriations bills. If passed by the US House and Senate, multiple Vermont-based projects stand to receive a significant influx of funds. Projects include several aimed at developing affordable housing and increasing homeownership equity in the state – something that is sorely needed in our current tight housing market.

- Read more in this article from VermontBiz and this article from Valley News.

- At the state level, recent legislature aimed at increasing tenants’ rights and improving housing equity in the state has faltered due to a lack of support. Burlington’s Just Cause Charter Change, which would have outlawed arbitrary, retaliatory, or discriminatory evictions was vetoed by Gov. Phil Scott and needed just one more vote in the House to overcome the veto.

- Read more in this article from VTDigger

Resources

Local news outlets have released guides to the 2022 election and are also worth checking out for coverage of events:

- VTDigger has published a 2022 Election Guide, which includes candidate guides, news articles, and multi-lingual resources.

- Vermont Public’s 2022 primary election can be found here and includes links to video debates between the candidates, as well as multi-lingual voting guides.